amazon flex taxes form

Tap Forgot password and follow the instructions to receive assistance. Knowing your tax write-offs can be a good way to keep that income in.

Amazon Sales Tax Accounting Tips For Amazon Sellers

1099 MISC Forms 2022 4 Part Tax Forms Kit 25 Vendor Kit of Laser Forms Compatible with QuickBooks and Accounting Software.

. We know how valuable your time is. Amazon Flex will not withhold income tax or file my taxes for me. Select Sign in with Amazon.

With Amazon Flex you work only when you want to. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906. Form 1099-NEC is replacing the use of Form 1099-MISC.

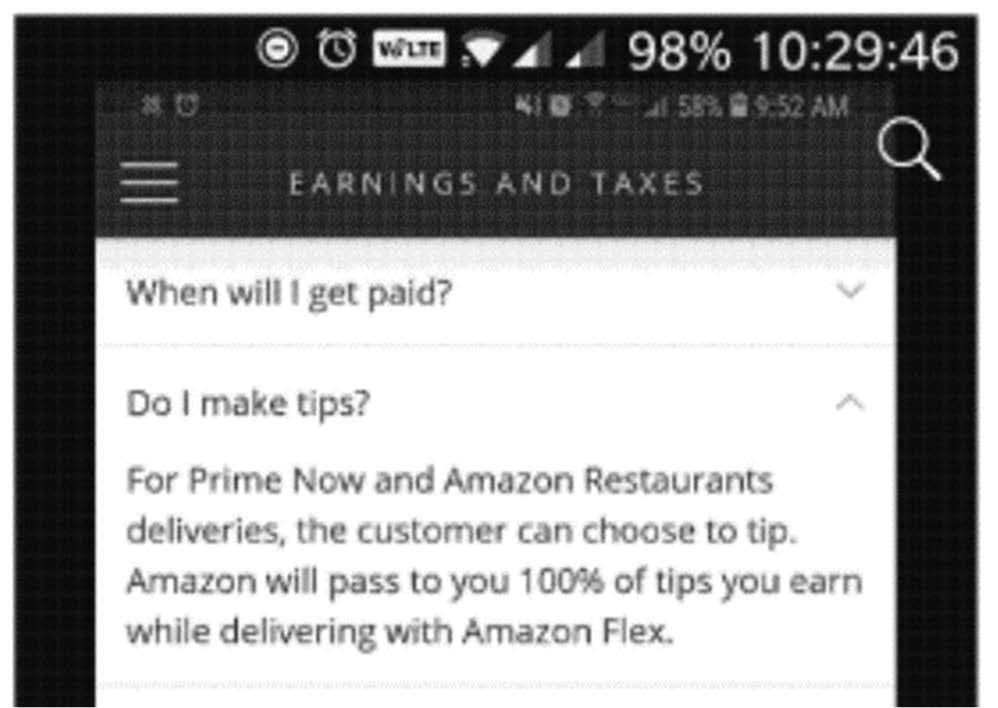

If you earn at 600 per tax year driving for Amazon Flex expect a 1099-NEC form in the mail from them by late Januaryearly February of the following year. Amazons Choice for 1099 misc tax form. 12 tax write-offs for Amazon Flex drivers.

If you dont want to wait for your Amazon flex tax forms you have two options. Payee and received nonemployee compensation totaling 600 or more Amazon is required to provide you a 1099. Increase Your Earnings.

Whatever drives you get closer to your goals with Amazon Flex. As an Amazon Flex driver you will likely be considered an independent contractor which means you will be responsible for paying self-employment taxes in addition to your income taxes. How Much Tax You Pay.

If you are a US. The tax year runs from 6 April to 5 April each year. Adjust your work not your life.

Driving for Amazon flex can be a good way to earn supplemental income. You expect to owe at least 1000 in tax for the current. Gig Economy Masters Course.

You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. As a self-employed independent contractor you will have to pay taxes and self-employment tax on your. So a tax return due by 31 January 2023 would contain amazon flex earnings between 6 April 2021 to 5 April 2022.

Skip to main contentus. 45 out of 5. The first option is to enter your income in your tax software as income you didnt receive a 1099 for.

The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after. 1099 Misc Tax Forms for 2022 with Envelopes 4 Part Laser Tax Forms Kit for 25 Individuals Income and 25 Self-Seal Envelopes -. We would like to show you a description here but the site wont allow us.

Tax Forms Access For Peoplesoft Customers Rrd

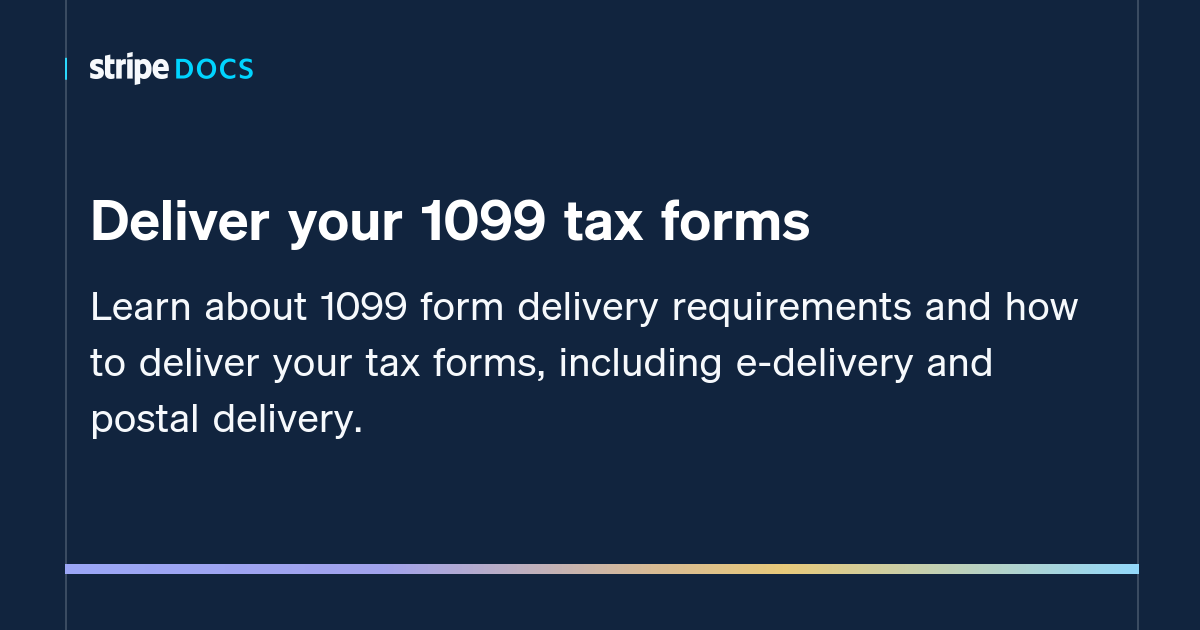

Deliver Your 1099 Tax Forms Stripe Documentation

Amazon To Pay 61 7 Million To Settle Ftc Charges It Withheld Some Customer Tips From Amazon Flex Drivers Federal Trade Commission

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

How To File Taxes For Dropshipping Or Ecommerce Mayple

Deliver Your 1099 Tax Forms Stripe Documentation

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

What Gig Workers Need To Know About Paying Taxes

Tax Forms Email R Amazonflexdrivers

7 Ways To Make More As An Amazon Flex Driver

Cares Act Allows Employers To Defer Employer Portion Of Social Security Payroll Taxes Tax Pro Center Intuit

Tax Forms Email R Amazonflexdrivers

How To Make Money On The Side With Amazon Flex

Amazon Flex Driver How To File Your Taxes In 2022 1099 Nec Youtube

Adding Up Wages Instead Of Waiting On 1099 R Amazonflexdrivers